Your Trusted Mortgage Partner in Calgary, Alberta – Get Pre-Approved Today

Limited Time Offer : 3.89% rate on Qualifying Applications, T&Cs Apply.

About Me

Alberta’s Go-To Mortgage Broker – Personalized Solutions, Trusted Support

Looking for a reliable, knowledgeable, and approachable mortgage broker in Alberta? You’re in the right place.

I’m a licensed mortgage broker in Alberta, proudly serving clients across the province – with a strong focus on Calgary, Airdrie, Cochrane, Okotoks, and Chestermere. While these are my primary service areas, I work with home buyers and investors throughout Alberta and am always ready to help wherever you are.

Backed by Mortgage Architects, a nationally recognized brokerage with a presence in multiple provinces, I bring you access to exclusive rates, flexible options, and direct connections with Canada’s leading banks and financial institutions.

As a young, dynamic professional, I combine industry expertise with excellent negotiation skills to help you secure the best mortgage solutions – whether you’re a first-time homebuyer, upgrading to a new property, investing in real estate, or financing a commercial project.

Brokerage

We are Mortgage Architects.

We are here for Canadians like you who are looking to fall in love with their first home, move up to their dream home or vacation property, or renew a mortgage using the equity in a home for everything from renovations to debt consolidation.

We are an established national Mortgage Brokerage led by a seasoned management team and supported by a network of experienced and caring Mortgage Brokers. We help homeowners ask the right questions, compare mortgage rates and privileges, design a mortgage based on their needs, and understand how to make their mortgage work for them.

Services I Offer

Get Your Mortgage Today

Why Choose Me?

Client Testimonials

EXCELLENTTrustindex verifies that the original source of the review is Google. Great experience dealing with a knowledgeable and courteous team. Would recommend for home buying realtor and mortgage services in YYC area

Frequently Asked Questions

Mortgage approval typically takes anywhere from a few days to several weeks, depending on factors such as your financial profile, credit score, and the lender's processing time. Providing all necessary documents upfront can help speed up the process.

Yes, you can still get a mortgage with bad credit, but it may come with higher interest rates and stricter terms. Some lenders offer specialized programs for borrowers with lower credit scores. Improving your credit before applying can help you secure better loan terms.

Interest rates fluctuate based on market conditions and your creditworthiness. To get the most accurate and up-to-date mortgage rates, it’s best to check with your lender or a financial institution.

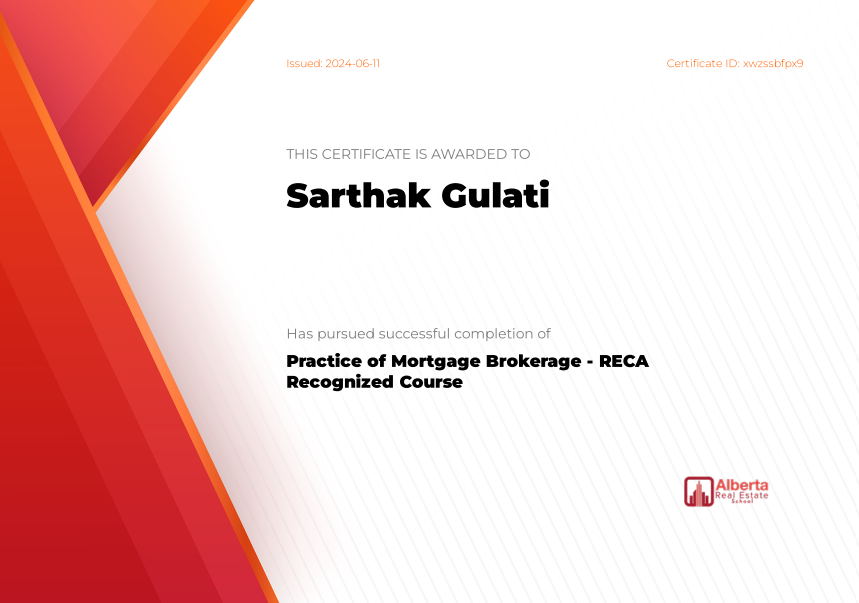

Accreditations & Certifications

Get In Touch

Ready to take the next step? Whether you’re planning to buy your first home or expand your real estate portfolio, I’m here to make the process smooth, informed, and stress-free.

Address

77 Panamount Villas NW Calgary, AB T3K 0A4